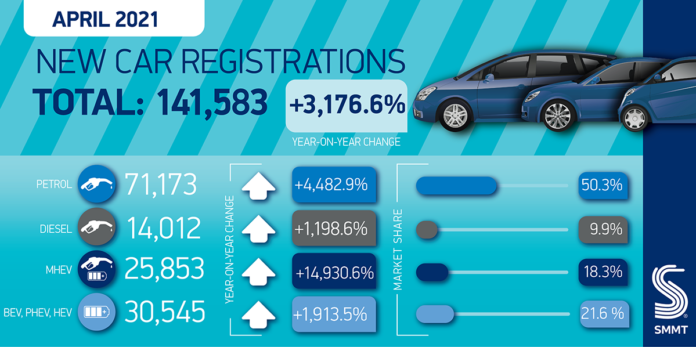

April saw an artificial 30-fold increase of new car registrations compared to the same month last year, but volumes still remained 12.9% lower than the 10-year average at just 141,583 new units, according to the latest figures released by the Society of Motor Manufacturers and Traders (SMMT).

This year’s monthly total dwarfed that recorded in April 2020, when the first national lockdown effectively shut the country, and just 4,321 cars were registered.

Retail demand saw the most significant recovery, rising from just 871 registrations last April to 61,935. Click and collect supported the market for the first week and a half until dealerships could reopen on 12 April – a marked contrast from the same month last year, where Covid restrictions effectively prevented private purchases.

However, April 2021’s consumer registrations were still 14.5% down on the 10-year average.

Total plug-in vehicle market share broadly followed the trend seen in recent months, accounting for just over one in eight vehicles, or 13.2%.

Unusually, plug-in hybrids (PHEVs), at 6.8% of the market, were more popular than battery electric vehicles (BEVs) at 6.5%, following cuts to the Plug-in Car Grant. Monthly BEV uptake was down compared with the first quarter overall, however, as they had been running at 7.5% of total registrations.

In light of the more upbeat economic outlook on the back of vaccine rollout and easing of the lockdown restrictions in line with government roadmap, SMMT has revised its forecasts upwards from 1.83 million – based on a snap poll in February – to around 1.86 million new cars to be registered by the end of the year, a 13.9% increase on 2020. However, this would still be some 20.2% down on the average of 2.33 million registrations a year recorded between 2010 and 2019.

Demand is likely to be driven by a broad range of new models and powertrains, with confidence bolstered by the gradual reopening of the country.

Mike Hawes, SMMT Chief Executive, said:

After one of the darkest years in automotive history, there is light at the end of the tunnel. A full recovery for the sector is still some way off, but with showrooms open and consumers able to test drive the latest, cleanest models, the industry can begin to rebuild. Market confidence is improving, and we now expect to finish the year in a slightly better position than anticipated in February, largely thanks to the more upbeat business and consumer confidence created by the successful vaccine rollout. That confidence should also translate into another record year for electric vehicles, which will likely account for more than one in seven new car registrations.