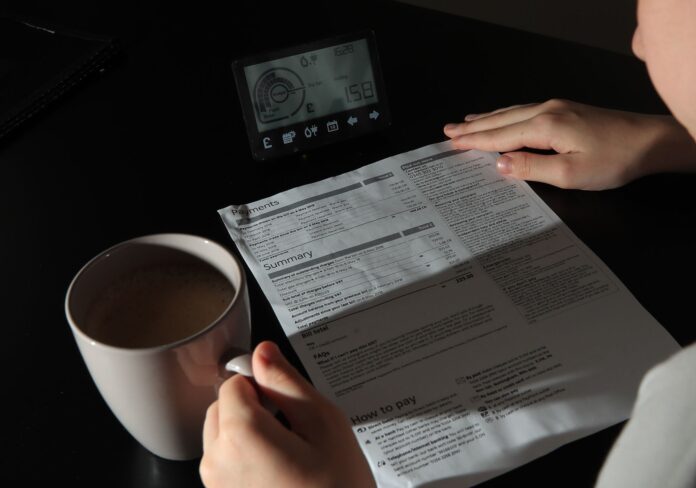

New analysis shows the impact of rising energy costs on household budgets. It finds that once housing costs are paid, even with the support package announced last month:

£1 in every £5 from low-income family budgets could go on energy costs this year

Single adults on low incomes could spend a shocking 49% of their incomes on energy

The average low-income family faces an extra £850 on their annual energy bill

The analysis from the independent Joseph Rowntree Foundation (JRF) highlights the stark impact of a scheduled real-terms cut to benefits next month, as rising energy costs threaten to devastate the living standards of families on the lowest incomes.

The analysis combines energy cost predictions for 2022-23 from Cornwall Insight which incorporate the significant increase in wholesale gas costs caused by Russia’s invasion of Ukraine, with the typical energy consumption patterns of households on different incomes. The figures take into account the measures announced by the Chancellor at the start of February to support households with rising energy bills, highlighting that these measures do not come close to mitigating the increase in costs.

Based on the energy cost predictions, families on low incomes could face annual energy bills of around £2,000 on average, an increase of around £850 per household compared to 2020-21. This means these families could be spending on average 19% of their incomes after housing costs on energy, or around £1 in every £5. For lone parent families on low incomes this rises to 26%, or £1 in every £4 and for single adult households on low incomes, this rises to a shocking 49% or £1 in every £2.

Households on low incomes, both in and out of work, will see a real-terms cut to their benefits in April, as the Government is planning to increase benefits by just 3.1% when inflation is forecast to hit 8%, despite widespread consensus from frontline charities, economists and think tanks that benefits should be uprated in line with expected inflation in April. [1] Recent JRF analysis found that this choice means nine million households on low incomes will experience a real-terms cut of £500 a year on average, a figure that will be higher now inflation is forecast to peak at an even higher level. [2]

This real-term cut follows a decade of underinvestment and cuts which have left the UK’s main out-of-work benefit at a 30-year low and comes less than six months on from the £20 per week cut to Universal Credit.

JRF is calling for urgent action to ease the pain of rising energy prices on the poorest households. At a minimum the Government should increase benefits by as close to inflation as possible in April, to protect people on the lowest incomes from a real-terms income cut. But the Government must also look at the adequacy of social security payments, to strengthen the support available and prevent the poorest households being exposed to every economic shock in future.

The 19% of incomes that will be taken up on energy costs among low-income families compares to around 7% on average for middle income families, highlighting that although increasing energy costs will impact families across the income scale, those at the bottom will feel the impact much more harshly. Last month the Chancellor chose to spread the support package for rising energy costs thinly across a wide range of households. But if energy cost projections prove accurate, the case for much more targeted additional support for those on the lowest incomes later in the year will become increasingly clear.

Katie Schmuecker, Deputy Director of Policy & Partnerships at JRF said:

“It defies logic to expect people to be able to cope with a steep increase in the cost of essentials when their incomes are not keeping up with inflation. We already hear countless examples of people across the country struggling to adequately heat their homes and feed and care for their families. Following a decade of cuts and freezes to the benefits system, this failure to keep pace with prices will cast more people into desperate situations. In a country as rich as ours in 2022, this is just not right.

“Our analysis shows that the Chancellor’s support to date is simply not going to protect households on the lowest incomes from the frightening increase in energy bills we are all going to face. Sharp rises in essential costs like energy and food are especially hard for people on fixed incomes to bear – this includes people who are unable to work due to disability or ill health or caring responsibilities.

“At a bare minimum, the Chancellor must increase benefits in line with inflation to prevent their value eroding further. This should be a first step in a wider plan to strengthen our social security system so that it protects people from economic shocks rather than pushes them into hardship.”