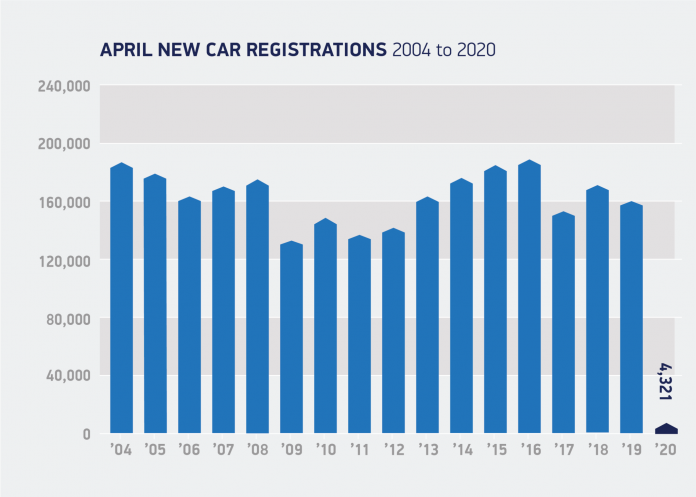

UK new car registrations declined 97.3% in April, according to figures published today by the Society of Motor Manufacturers and Traders (SMMT). This marked a record low for the new car market as the coronavirus pandemic forced the nation into lockdown for the entire month, with showrooms closed and car buyers housebound.

Just 4,321 new cars were registered in the month, some 156,743 fewer than in April 2019, with many delivered to key workers and front line public services and companies. The decline was the steepest of modern times, and is in line with similar falls across Europe, with France 88.8% down and the Italian market falling 97.5% in April.

Despite showrooms being closed for the month of April, companies managed to support key workers, critical companies and frontline services. Meanwhile, the industry has continued to keep service and repair workshops open to maintain vehicles that are so crucial in keeping key services, goods and people moving safely across the country.

The news comes as SMMT releases its latest new car market forecast for 2020, downgrading previous expectations to just 1.68 million registrations. This puts the sector on course to record its worst performance since 1992’s 1.59 million units, below the levels seen during the financial crisis and some 27% lower than the 2.31 million new cars registered in 2019. Despite this, the BEV market is expected to double in 2020 to 77,300 units as new model introductions bolster the market.

Mike Hawes, SMMT Chief Executive, said,

With the UK’s showrooms closed for the whole of April, the market’s worst performance in living memory is hardly surprising. These figures, however, still make for exceptionally grim reading, not least for the hundreds of thousands of people whose livelihoods depend on the sector. A strong new car market supports a healthy economy and as Britain starts to plan for recovery, we need car retail to be in the vanguard. Safely restarting this most critical sector and revitalising what will, inevitably, be subdued demand will be key to unlocking manufacturing and accelerating the UK’s economic regeneration.

Christian Stadler, Professor of Strategic Management at Warwick Business School and an expert on the automotive industry, said:

“The fact that UK car sales have reached their lowest level since 1946 is not really surprising, after all we are in lockdown. A far bigger concern for car companies is that sales are unlikely to bounce back after the lockdown is eased.

“Demand for new cars was already falling before the pandemic and many people will feel less secure financially and more concerned about their jobs due to COVID-19. They may hold off buying a new car, especially with Brexit hanging over them as well. They might also feel less inclined to visit a car show room if social distancing measures continue.

“If demand remains low, manufacturers and their suppliers will lose the economies of scale that come from producing large volumes of cars and that will drive up costs, which they will be reluctant to pass on to customers.

“This comes at a very inopportune time for the industry, when companies have been investing heavily in electrification. It is likely there will be some job losses.

“However, there are some crumbs of comfort for the industry. Oil prices are low and commuters may be more reluctant to use public transport after lockdown, which could encourage them to buy a new car, if they are no longer working from home.

“Also, car companies are in a better position to weather this storm than they were the financial crash in 2008, when they had little money in the bank. Many car companies learned from that and have been careful to build up cash reserves, securities, and credit lines they can draw upon. VW has access to £47.5 billion, Daimler has £30 billion and PSA has £19 billion.

“We have also seen that Governments are willing to loosen their spending restrictions to support the economy during this pandemic. They may well be willing to offer some help to the car industry to protect jobs. After the financial crash we saw a car scrappage scheme to boost sales. While it wasn’t a complete success, it wouldn’t surprise me to see something similar this time, though some countries may seek to direct any support towards encouraging customers to buy electric cars.”