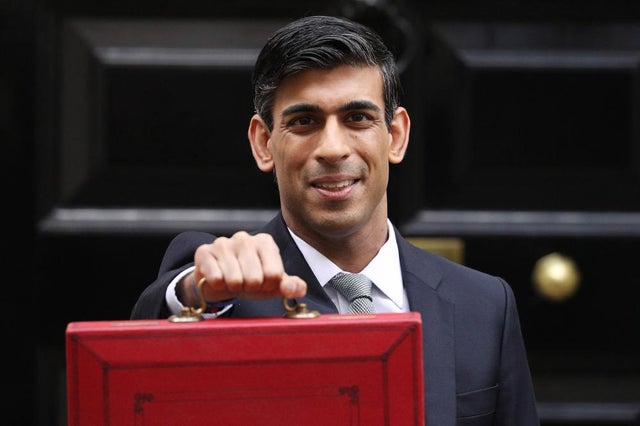

The Chancellor Rishi Sunak extended the country’s emergency programmes to see the economy through the COVID crisis but announced a future tax squeeze on businesses and individuals as he began to focus on the huge hole in the public finances.

Presenting the budget this afternoon Sunak said that the economy will regain its pre-pandemic size in mid-2022, six months earlier than previously forecast, helped by Europe’s fastest vaccination programme but it will l remain 3% smaller in five years’ time than it would have been without the health crisis.

The Chancellor confirms that the furlough scheme will contine to September along with support for the self employed-Firms will start to make contributions from July onwards

For the self employed people whose turnover has fallen by 30% or more will continue to receive the full 80% grant. People whose turnover has fallen by the left the 30% will therefore have less need of taxpayer support, and will receive a 30% grant.

There will be £19m for domestic violence programmes and to “pilot a network of respite rooms”, providing specialist support for vulnerable homeless women.

A further £10m will be provided for veterans with mental health needs.

And the funding for victims of the thalydamide scandal is being extended by £49m alongside a lifetime commitment “guaranteeing funding forever”

The Universal Credit uplift of £20 will continue for a further six months.

For hospitalty and tourism the 5 per cent VAT rate will contine until September and then it will be pegged at 12.5 per cent for the next six months

Non essential retail will get £6,00 per premises as they open first.Hospitality and leisure, including personal care and gyms, will open later so they will get grants of up to £18,000.

Coronavirus has caused one of the largest, comprehensive and sustained economic shocks this country has ever faced borrowing 17 per cent of our national income, the highest level since World War II.

Next year it is forecast to be £234bn “an amount so large it has only one rival in recent history – this year”,

But borrowing will fall to 4.5 per cent of GDP in 2022/23, 3.5 in 2023/24 and 2.9 per cent and 2.8 per cent in the following two years. He says underlying debt will peak at 97.1 per cent in 2023/24 before stabilising and falling slightly.

Income tax bands will be frozen until 2026 Nobody will be taking home less this year than last says the Chancellor

Corporation tax will increase to 25% in 2023, “This new higher rate won’t take effect until April 2023, well after the point when the OBR expect the economy to have recovered,”

It’s the first time a chancellor has raised corporation tax since Denis Healey in 1974.

Businesses with profits of £50,000 or less would pay a new Small Profits Rate, maintained at the current rate of 19%.

To offset the hit, Sunak increased incentives for investment in items such as new equipment over the next two years. “This will be the biggest business tax cut in modern British history,” he said.

Sunak also said he would freeze in a year’s time amount of money that people can earn tax-free and the threshold for the higher rate of income tax until 2026.

Planned increases in duties for spirits, wine, cider and beer will be cancelled, with all alcohol duties frozen for a second year in a row,there will be no increase in fuel duty either.

According to the Office for Budget Responsibilty the tax rises and spending cuts announced today are sufficient to eliminate all but a £0.9 billion current budget deficit in 2025-26.