The Bank of England says its models show that nearly a million mortgage holders across the UK will see monthly repayment increases of £500 or more in the coming months that’s the equivilent of £6,000 a year.

However the forecast also says that the share of highly indebted households is unlikely to get anywhere near 2008 levels,unless interest rates were to go up another three percentage points

The Bank’s Financial stability report published this morning said that while some borrowers may struggle with repayments, UK banks are strong enough to support their customers and all the lenders it assessed passed stress tests

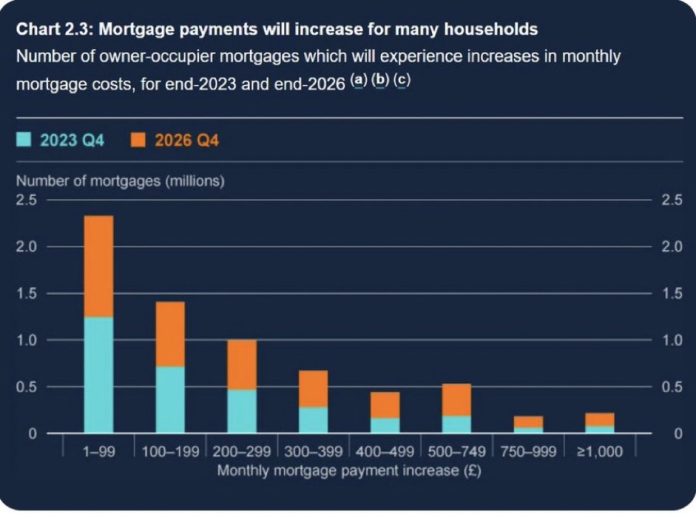

In a detailed report the Bank said that million households will see their monthly mortgage payments increase by up to £199 by the end of this year as their fixed-rate mortgages expire, while a million will see payments jump by £200-£499, according to data in the Bank’s financial stability report.

By the end of 2026, around 200,000 households will see their monthly mortgage bills rise by £1,000 or more.

Over 4 million people are forecast to come off fixed Mortgages by the end of 2026

Shadow Chancellor Rachel Reeves said that today’s Bank of England forecast shows yet again the painful hit on families from the Tory mortgage bombshell.