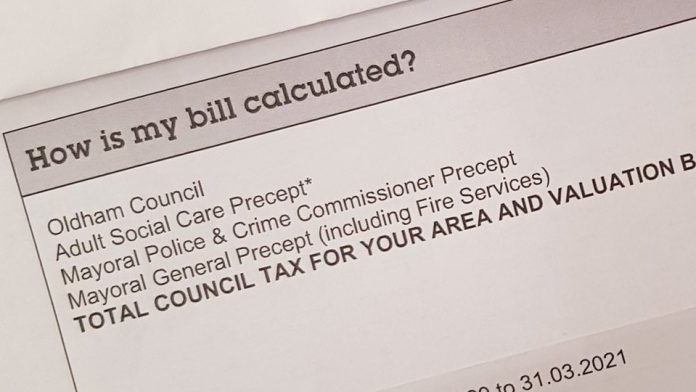

Unfair and outdated council tax bands mean that Northern households are overpaying by £250 a year on average, a total of £1.2bn, according to a new report out today

New modelling from the Northern Powerhouse Partnership and Open Innovations shows that uneven changes in the UK property market over the past three decades mean that someone living in a house in Hartlepool worth £150,000 pays over £200 a year more in council tax than a person in Westminster in a property worth £8million according to campaign group Fairer Share.

A property in Gateshead will likely see their council tax bill go up by over £116 this year, compared to £45 in Westminster.

The Levelling Up, Housing and Communities Select Committee recently urged the government to begin the long-overdue revaluation of properties as part of wider reform to local government financing.

The Secretary of State for Levelling Up, Housing and Communities Michael Gove told a select committee hearing in December that “every party will want to put forward probably in its manifesto proposals for improving local government taxation.” He has said in the past that council tax is “regressive”.

The tax rate as a share of value for a band A property is about five times, on average, what it is for a band H.

Work should begin immediately on a revaluation of all properties in England before the General Election. At the very least, a localised re-banding – which would maintain the current proportion of properties in each band for each council – would bring valuations into the 21st century with a revenue neutral approach.

While this is an important first step, it would still leave many in the most deprived parts of the country overpaying.

We should therefore consider introducing three new council tax ‘super bands’ for properties worth more than £2 million, paid by the owner not occupier. This could generate £9billion, raised mainly from houses in central London, assuming a 8x multiplier on properties over £2million, 16x multiplier on properties over £10million and 32x multiplier on properties over £20million.

The revenue gained from these super bands would be shared across the country through a cast-iron transfer system, replacing the local government settlement. Open Innovations has developed a tool which allows local authorities to see what this new system could mean for their area

Local authorities are facing a £4bn funding gap over the next 2 years to maintain services at current levels, according to the Local Government Association.

The Office for Budget Responsibility (OBR) reported following the Autumn Statement that unprotected day-to-day departmental spending, which includes core funding distributed by the Department for Levelling Up, Housing and Communities to local authorities, would need to fall by 2.3% per year in real terms from 2025–26.

Henri Murison, Chief Executive at the Northern Powerhouse Partnership, said:

“Michael Gove himself has said that council tax needs reform.

“The current system is inherently regressive and unfair, with too many properties banded too highly, and vice versa, due to outdated figures. With a quickly growing number of councils filing – or close to filing – for bankruptcy, the government should announce a revaluation, which is now more than 20 years overdue, at the spring budget.

“Far reaching reform of the council tax is needed alongside a wider package of fiscal devolution, with cast iron transfer mechanism – independent of ministers – to ensure less prosperous areas can still pay for key services such as social care.

“This is vital to help get local government financing on a more secure footing and to reduce dependency on the Treasury in the long-term.”

Andrew Dixon, Chair of Fairer Share, said:

“Council tax has led to low-income households paying 5 to 10 times the tax rate compared to those fortunate to live in multi-million pound properties. Council tax is regressive and outdated. It needs a complete overhaul.

“People up and down the UK are sick to the back teeth of council tax. They overwhelmingly want a fairer system in its place that reflects the true value of their homes. Our polling shows just how strong that feeling is and how reforming our property taxes holds the key to success at the next general election.

“Council tax places the greatest burden on the young, low-earners, and residents in less prosperous regions, while benefiting wealthy homeowners and property investors. Those who have benefited the most from house price increases have also been the biggest beneficiaries of the council tax system.”