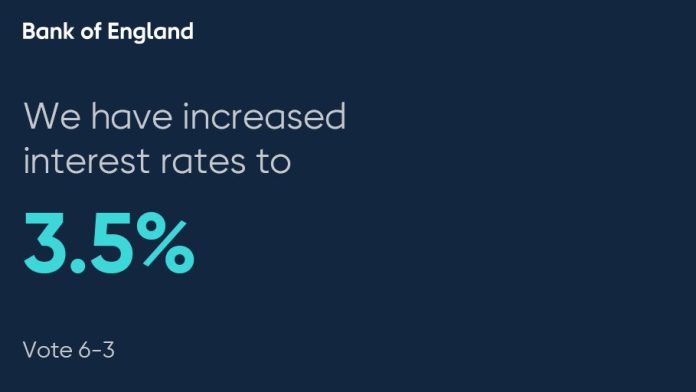

The Bank of England has raised interest rates by 0.5 per cent this lunchtime,the ninth consecutive rate rise

The lending rate now stands at a 14 year high of 3.5 per cent

The rate setting Monetary Policy Committee chaired by the Bank’s Governor Andrew Bailey, voted 6 to 3 for the increase, which was in line with City expectations.

Two members wanted a freeze. Another wanted an increase 0.75 per cent

The change in UK interest rates since last Dec is the biggest year-on-year increase since 1989

This time last year interest rates were just 0.25 per cent

Alpesh Paleja, CBI Lead Economist, said:

Another big interest rate rise from the Bank of England doesn’t come as a surprise, in the face of historically high inflation. However, with global prices pressures starting to wane, along with the economy set to fall into recession, it is likely that we’ll see smaller interest rate rises for the foreseeable future.

Nonetheless, high inflation and weakening activity will continue into 2023, putting strain on many households and businesses. With monetary policy focused on tackling inflation, the government must use economic levers to stem the severity of an oncoming downturn, but also to address the UK’s persistent weakness in investment and productivity. We cannot afford to have another decade where both are stagnant.