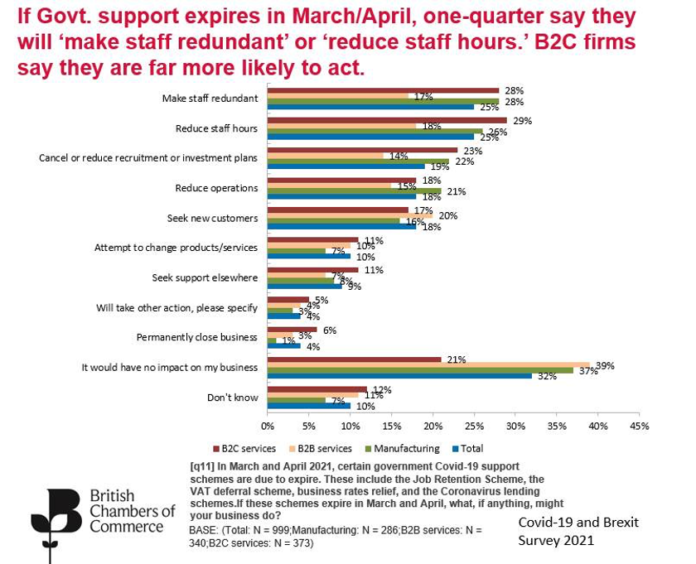

A quarter of British businesses expect to fire staff if finance minister Rishi Sunak does not extend a job furlough programme that is due to expire at the end of April, taccording to the British Chambers of Commerce.

Their survey of more than 1,100 businesses found that Three in every five firms have seen their revenue from UK customers fall in the last three months and almost a third of business-to-consumer (B2C) firms say they will run out of cash in the next three months.

The business group has called on the UK government to set out a clear roadmap for reopening, advancing vaccination and workplace testing plans, and extending key financial support measures for businesses throughout 2021.

Compared to October 2020, 61% of firms reported decreased revenue from UK customers. Only 19% of firms reported increased revenue and 20% reported no change. B2C service firms are significantly more likely to report decreased revenue from UK customers, as are firms with less than 10 employees .

When asked approximately how long firms could continue until they ran out of cash, almost one-quarter said less than three months. This figure rises to almost one-third of B2C service firms. Just over one quarter of firms overall and only one-fifth of B2C firms have cash for more than 12 months.

The results paint a bleak picture of a business landscape which has been severely squeezed by repeated lockdowns and massive changes in trading conditions. The survey results also suggest that without the huge amount of government support given to companies to date, that business failures and job losses could have been much worse.

Crucially, more support is needed until firms can fully reopen, with just over a quarter of businesses indicating they have enough cash to last more than a year. On average, B2C firms are currently operating at only 42 per cent of full capacity, while all firms were averaging 57% capacity against a pre-pandemic level of 75 to 80 per cent. Almost half of companies reported they still have staff on furlough.

Responding to the survey results, BCC Director General Dr Adam Marshall said:

“The last year has taken a heavy toll on businesses across the UK. With cash flow still the top concern, it is vital that the UK government keeps financial support going until firms can reopen and rebuild. Pulling the plug now would be a huge mistake, and would be akin to writing off the billions already spent helping firms to survive.

“Firms are desperate to start trading again so they can boost revenue and start thinking about the future. To do so they need to see a clear, evidence-based plan for reopening, and they need time to get back on their feet without unnecessary additional taxes, and the security of knowing that Government will once again support them should we see additional restrictions imposed at any point.

“In the meantime, support must remain in place for firms that need it until a full reopening of the economy is possible. With cashflow being a major challenge for many businesses, we can expect to see further redundancies or business failures should Government support end prematurely.

“Alongside a clear roadmap for reopening, business confidence will also come from a commitment to further accelerate the vaccination programme and a wider workplace testing strategy that’s accessible to businesses of all sizes.”