Decarbonising the North’s industrial sector can be largely funded by the private sector, according to a new report by business-led thinktank the Northern Powerhouse Partnership (NPP). The report builds on new analysis from Cambridge Econometrics which shows that industrial decarbonisation and reducing emissions from real estate are the sectors offering the highest potential private investment leverage overall. The report suggests that for every £1 of public money invested, at least £4 can be generated from the private sector, demonstrating the substantial economic benefits of these initiatives.

This analysis comes as South Yorkshire’s Mayor, Oliver Coppard announced the creation of SY Energy, a partnership with the private sector and academics that will maximise investment, jobs and supply chain development in the area’s leading clean-tech sector.

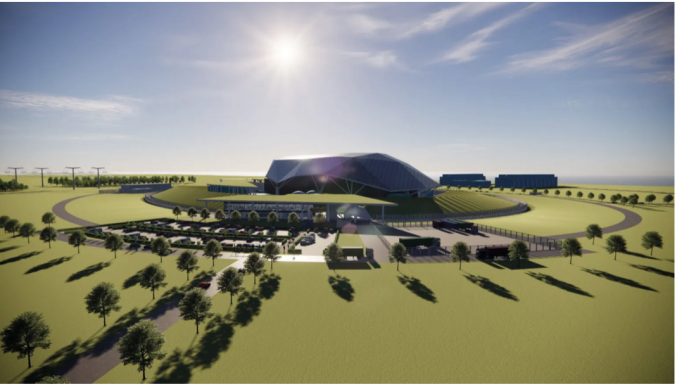

South Yorkshire has unique strengths in Small Modular Reactors, Hydrogen and Sustainable Aviation and is aiming to become the natural home for these emerging sectors. SY Energy will work to de-risk investment decisions for clean-tech businesses together with the South Yorkshire Mayoral Combined Authority who will help to attract talent and develop targeted skills programme. Businesses will also be supported to grow and build links with other regions and businesses in the UK and across the world.

Across the North, private funding that can be attracted to industrial decarbonisation includes £15bn across the Humber for bioenergy initiatives with £2bn specifically allocated for carbon capture and storage (BECCS) technology at Drax power station in Selby. This is alongside £5bn towards HyNet’s hydrogen clusters on the Mersey as well as separate further investment on the Tees.

For the overall net zero economy, it is projected that at least £2.65 could be leveraged for every £1 of public money. This includes a greener transport system and renewables such as offshore wind and nuclear energy. The lowest leverage estimated is in land use.

On a project-by-project basis, areas funded by the new wealth fund will need to achieve a leverage ratio of 1:3 ratio, meaning £3 of private investment for every £1 of public funding. NPP also supports the use of Treasury Guarantees by the bank to invest pension fund monies. This would require no up-front government help, making it easier to exceed the leverage ratio and maximise investment impact.

This new report builds on the Northern Powerhouse Independent Economic Review Scenario, which showed investing in net zero could deliver £23bn more in GVA and over 168,000 additional jobs to the Northern economy. Crucially, this would deliver a much-needed boost to the North’s historically sluggish productivity equal to £1,500 per worker.

The report also warns that the North of England, which produces nearly half of the UK’s electricity, and is home to half the country’s most carbon-intensive clusters, is uniquely vulnerable to a botched transition to net zero. The Humber alone represents 40% of the UK’s industrial emissions.

Instead of offshoring our emissions to reach net zero targets artificially, we need a decarbonisation strategy to protect workers in key industries such as steel. In Scunthorpe the future of two blast furnaces were jeopardised by a failure to deliver a carbon capture pipeline sooner, and the North can’t risk similar mistakes in the future.

Henri Murison, Chief Executive of the Northern Powerhouse Partnership, said:

“The private sector needs to be the lead player in decarbonising our economy and investing in emerging green sectors.

“Billions in private investment is ready to flood into the North’s net zero economy.

“The North of England bore the brunt of the UK’s last rapid de-industrialisation – which took place without a plan to protect workers – which is why we need to stop artificially reducing emissions by moving our heavy industries overseas.

“With the right plan, delivered well, we could use the net zero transition to drive our region’s economy and close the North-South divide for good.”