New research by reallymoving.com into house price affordability by occupation has revealed that Manchester is the second most affordable city in the UK for low earners who wish to buy their own home, behind Glasgow.

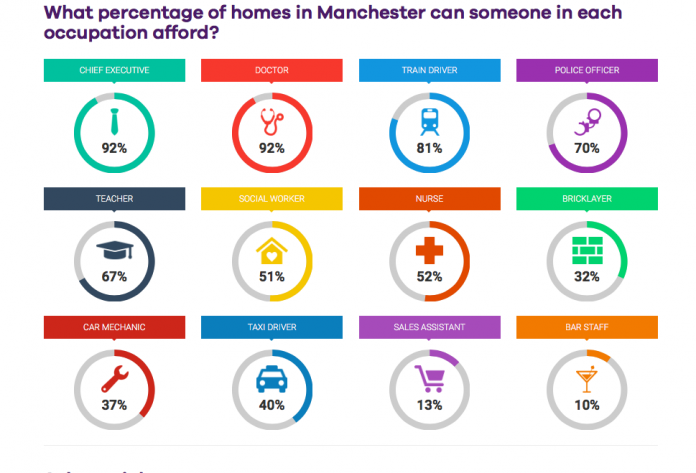

Sales assistants in Manchester, earning on average £15,758, are able to afford 13% of all homes in the city, compared to 2% in London or 4% in Birmingham, while Manchester’s taxi drivers earning £26,215 can afford 40% of homes and car mechanics earning £25,358 can access 37% of the property market.

Manchester also offers plenty of choice to middle earners, with nurses able to afford 52% of homes and teachers 67%, while CEOs, earning on average £76,433 per year, have the choice of 92% of the city’s housing stock.

Meanwhile train drivers, who enjoy average annual salaries of £51,874, can afford to buy a remarkable 81% of all homes in the city, a far greater proportion than professionals such as police officers, teachers, nurses and social workers.

However, despite Manchester being the second most accessible city for homebuyers, house prices have risen much more quickly than wages over recent years, leading to worsening affordability. According to the Land Registry, the median house price in Manchester has increased from £135,000 in 2016 to £150,000.

The analysis, carried out by home move comparison site reallymoving.com, uses the latest ONS Survey of Hours and Earnings, alongside the Land Registry’s Price Paid Data, to reveal the percentage of homes people working in different occupations can afford. An online interactive infographic allows users to search for data by city or occupation.

Despite falling house prices in recent months, London remains the UK’s least affordable city, with police officers able to afford to buy just 8% of homes and teachers only 7%. Low earners such as bar staff and retail sales assistants have now been almost entirely priced out of the capital, affording just 1% and 2% of homes respectively.

CEOs fare the best across the UK, including in Manchester where they can afford 92% of homes.

Rob Houghton, CEO of reallymoving.com, said: “The home ownership dream is very much alive in Manchester, a city which offers excellent prospects for people wishing to get on the housing ladder. Middle earners in particular, such as nurses, bricklayers, car mechanics and taxi drivers, enjoy excellent affordability while even low earners such as bar staff and sales assistants, still have a decent chance of buying their own home.

“However, affordability has worsened across the UK, including in Manchester, due to rising house prices and stagnating wages. Unless we see wages increasing in real terms over the next year, the gap between what people can afford to spend and the price of a home in the city is likely to continue to grow.”